Open source lab test pricing data, and why prices vary so much

Hospital lab tests are commodities: a test is a test is a test. So how can end up with a $8,500 mole biopsy or a $28,000 strep throat cell culture? Many investigations raise this question but stop short of answering it.

We dug into this question a little bit, and we're also releasing never-before-seen data on hospital lab test prices. Feel free to download it and tell us what you think.

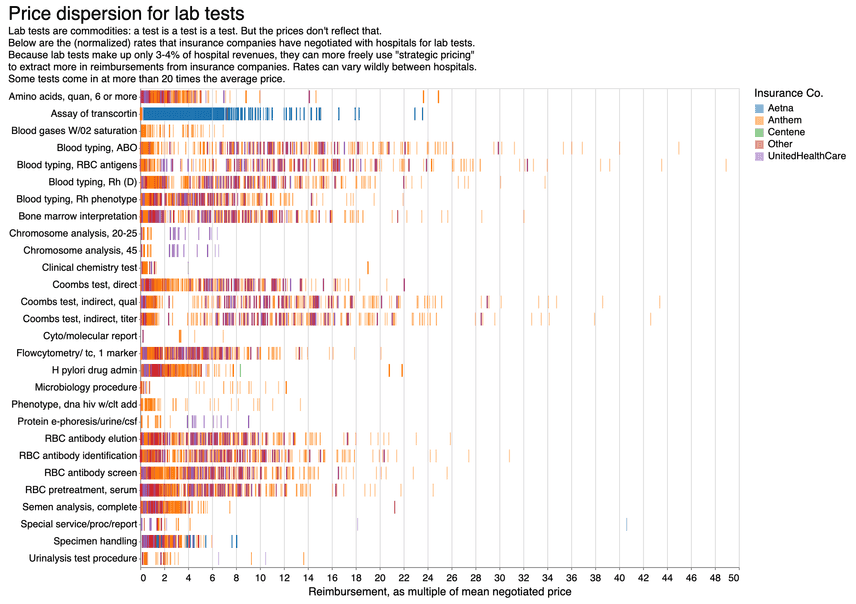

The range is really all over the place. In fact, lab test prices probably vary (by percent) more than any other kind of hospital service. And while many hospitals offer reasonably-priced labs, a number of them price their rates at 10, 20, or even 30 times the average. (We identify some of these hospitals further down the page.)

Some of the methods I used to find the expensive hospitals are in this notebook. You can suggest your own analysis if you want, or offer improvements to this one.

Surgeries require a steady hand and thousands of hours of training, but most labs require some stock machines, reagents, and a Bachelor's degree. So how do rates vary so much?

Counterintuitively, one of the reasons that lab tests can end up being so expensive is partly because they start so cheap. But let me explain first roughly how prices in hospitals get set:

Two parties ultimately negotiate rates: insurers and hospitals. (You — don’t get a seat at the negotiating table, even though you usually pay part of the bill.) Insurers and hospitals rarely negotiate prices for single procedures. Instead, prices are negotiated in contracts that include lots of them. Neither party cares about making individual rates make sense. They both mainly care about getting a good deal on average over all procedures billed during the next year or two.

Strategic pricing

Because of strategic rate setting, our charges were no longer in line with our costs — Hospital CFO

Take this made-up example to see how this plays out:

- Hospital A negotiates per $2,000 MRI, but charges a reasonable $4,000 for a knee surgery.

- Hospital B might charge a mere $500 per MRI, but an aggressive $16,000 for a knee surgery.

An insurance company can do some math and figure it can come out on top in both deals, depending on which hospitals get which patients. But this creates so-called “price dispersion” that separates prices from what things actually cost.

Hospitals call this “strategic pricing.” The ultimate idea is to maximize insurance reimbursements by decoupling costs from prices. Because expensive procedures (like spinal surgeries) tend to be scrutinized (or operate under entirely separate negotiation arrangements) you see this this strategic pricing especially on smaller-ticket items like lab tests.

For many hospitals, labs don't generate a whole lot of revenue. But because they only account for 3-4% of charges, hospitals can make up the difference on other, more expensive items, and keep running the labs in-house as a sort of convenience to the patients. Still, they’ve been under pressure for years to make these labs profitable, with hospitals trying to improve efficiency by farming out tests to nearby practices.

One way to offset the cost of running the labs is to just raise prices. “Strategically priced" by a hospital, and making up a small part of the revenue mix, unusually high lab test prices can be easily glossed over in negotiations. This can lead to prices that don’t even come close to reflecting the true cost of the lab.

Just looking at the data context-free, it's impossible to know the exact reason why some hospitals' tests are more expensive than others. All we can say is that if prices were aligned with costs, the prices should be pretty uniform, apart from some overhead per hospital.

Surprisingly, what we find is that a small number of hospitals have many lab tests priced at more than 20 times the mean. The last hospital on the list, Havasu Regional, has around 50 such tests in our dataset. (No response yet from the hospital, despite reaching out.)

| Num. tests > 20x mean price | Hospital name | City | State | NPI Num. |

|---|---|---|---|---|

| 9 | BAYLOR UNIVERSITY MEDICAL CENTER | DALLAS | TX | 1447250253 |

| 9 | BAYLOR REGIONAL MEDICAL CENTER AT PLANO | PLANO | TX | 1649273434 |

| 9 | UNIVERSITY OF TEXAS SOUTHWESTERN MEDICAL CENTER AT DALLAS | DALLAS | TX | 1285798918 |

| 9 | MUENSTER HOSPITAL DISTRICT | MUENSTER | TX | 1699770149 |

| 10 | CHILDRESS COUNTY HOSPITAL DISTRICT | CHILDRESS | TX | 1326079534 |

| 10 | VHS HARLINGEN HOSPITAL COMPANY LLC | HARLINGEN | TX | 1154618742 |

| 13 | YOAKUM COMMUNITY HOSPITAL | YOAKUM | TX | 1881697878 |

| 15 | YAVAPAI COMMUNITY HOSPITAL ASSOCIATION | PRESCOTT | AZ | 1902897820 |

| 47 | YUMA REGIONAL MEDICAL CENTER | YUMA | AZ | 1194706655 |

| 49 | HAVASU REGIONAL MEDICAL CENTER LLC | LAKE HAVASU CITY | AZ | 1780761866 |

Note: funnily, most of these hospitals are in the Southwest, and I'm not sure why.

So what's the problem with this?

You don't order the tests yourself. Your doctor does. But your doctor isn't on the hook for the costs.

Your insurer has some incentive to lower lab test costs overall, but since it's considering all lab tests as part of a bigger mix of hospital procedures, it doesn't have any reason to worry about the individual cost of labs. And if they want, they can decline to cover a lab -- for example, a test that was accidentally ordered twice in a span of a few months. In that case, you end up on the hook for the bill, for a price that was negotiated by the insurance company -- a price that bears little relation to the true cost of the test.

If your takeaway is that insurance companies (or hospitals) are bloodsucking parasites, the point isn't really that. Both hospitals and insurers are doing what they can, under the rules of the current system, to extract as much profit as possible from their arrangements. The only party involved in this negotiation who doesn't really get a choice is you.

And you have especially little choice if you live near a hospital like Havasu Regional, since the next nearest one is an hour away.

If you want to learn more

We’re collecting an immense amount of this data into a single database. The work was sponsored by Quest Diagnostics, who are using this data to show how their rates for labs compare to hospital rates.

For more on this, check out our open source data pipeline for dealing with the insurer MRF files. They're licensed under Apache 2.0, feel free to use them. You can write to me at alec@dolthub.com if you have any questions.

You can also hop on our active Discord to join a data bounty or make suggestions.